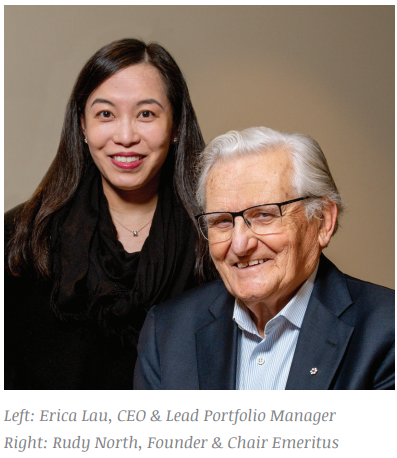

Our Growth at a Reasonable Price investment philosophy is the cornerstone of our business. This philosophy was developed by our founder, Rudy North, and has been in place since he first started managing U.S. Equities in 1964. Through decades of investing and various market cycles we hold true to our process which he passed onto our current investment team.

Diligence

We look at growth on a long-term basis. We examine the companies we consider individually and in detail. We analyse their balance sheets, income statements, and management teams.

We invest in solid, growing companies that are currently undervalued by the market due to short-term factors. To find these opportunities we commonly use traditional valuation metrics, like price/earnings (P/E) ratios, to value stocks.

Discipline

Fundamental research is critical to our fund managers’ decision-making process. A solid knowledge of a company’s operations is required in to be able to assess an organization’s long-term growth prospects. The free flow of ideas and sharing of research required to make intelligent investment decisions is facilitated by our open office layout.

We steer away from initiating positions in overvalued stocks because although a company’s earnings might be expected to grow long term, valuations based on price/earnings levels cannot be expected to grow indefinitely.

Alignment

Having our own financial interests completely aligned with those of our clients is a core company value. Our Portfolio Managers are personally invested in our funds and do not hold individual stocks.

We are incredibly motivated to succeed — for our clients’ sake and our own, and we pay the same fees, receive the same distributions, and benefit from the same performance returns as our clients. We believe that our complete alignment of interests and high level of transparency benefits all investors.